NAHDI CLOSES 2024 WITH 8.4% YOY REVENUE GROWTH AND MEETING THE PROFITABILITY GUIDANCE

nabdalhadath – Ahmed Bin Abdulqader

Nahdi Medical Company (“Nahdi” or “the Company”), Saudi Arabia’s leading purpose-driven healthcare and wellbeing Company, today reported its financial results for the fourth quarter of 2024 (“Q4 2024”) and fiscal year 2024 (“FY 2024”).

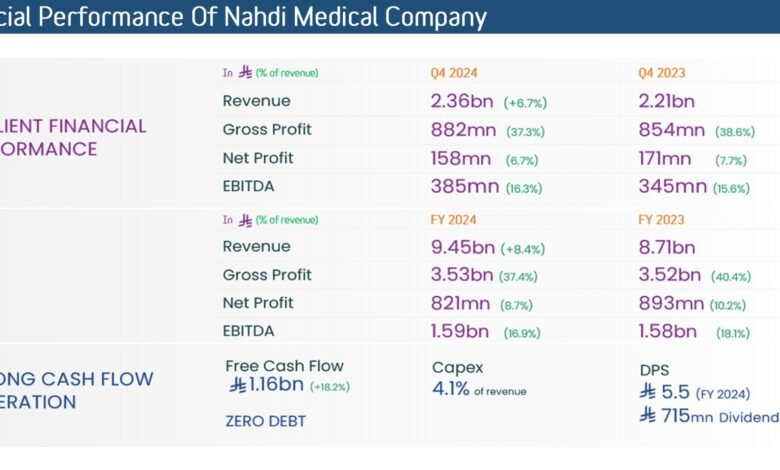

Q4 2024 HIGHLIGHTS

- For the fifth consecutive quarter, revenue grew by 6.7% year-on-year, driven by a 4.8% increase in the Retail business.

- Strategic initiatives continue to deliver strong performance with Healthcare & UAE revenue growth of 84.5% & 85.1%, respectively.

- Net profit declined by SAR 12.7 million, despite the increase in the gross profit which was offset by higher investment to support future strategic initiatives.

FY 2024 HIGHLIGHTS

- Ahead of Nahdi’s initial plans, revenue surged by 8.4% reaching SAR 9.45 billion driven by the strong performance of the Pharmacy retail business.

- The emerging businesses continued to experience remarkable growth, doubling revenues for the third consecutive year, with increases of 98.3% in Healthcare & 132.6% in UAE.

- Nahdi achieved a market-leading gross margin of 37.4% and recorded a 0.3% increase in gross profit. This was achieved despite the strategic adjustment in pricing to maintain competitive value for our guests while aligning with global offerings. These actions supported sales performance and fueled strong top-line growth.

- Efficient OPEX management reduced operating expenses as a percentage of revenue to 28.5% in 2024, while the operating expense increased by SAR 104 million, driven by continued strategic investments. As a result, operating profit recorded SAR 873 million.

- Net profit reached SAR 821 million, supported by the income from Islamic Murabaha time deposits and a one-time Zakat provision release.

- EBITDA for 2024 slightly grew by 0.9%, reaching SAR 1,595 million compared to SAR 1,581 million in the previous year. Nahdi remained a highly profitable business, achieving a best-in-class EBITDA margin in the sector for another year at 16.9%.

Strategic key highlights (as of 31 December 2024)

- Nahdi continued winning with its Guests, as shown through the highest Brand equity score in the sector of 6.9, Net Promoter Score (NPS) of 90, which is reflected in the growth of Nahdi’s market share.

- Prioritized Guests’ access to health and well-being by ensuring they are within 5 minutes reach of our services, with 1,156 Nahdi Pharmacies across Saudi Arabia serving 135+ cities & villages.

- Strengthened regional presence with reaching 25 pharmacies in the UAE.

- Sales contribution from e-commerce platforms increased to 22% from 16.6%, reflecting Nahdi’s commitment to being with its Guests wherever they are.

- Nahdi continued to grow its global offering with all global trends through a wide selection of products beyond the pharmacy premises. Nahdi managed to add more than 21,000 SKUs into the company’s product portfolio that gives a wider variety of choice to its Guests.

- Private Label and Differentiated Brands contribution reached 13%, with the introduction of Private Label products in Medicine, supporting local content and the “Made in Saudi” program.

- The Company’s Omnihealth footprint added 4 new NahdiCare polyclinics extending its total network to 10 polyclinics across 7 cities, including Jeddah, Makkah, Taif, Madina, Yanbu, Najran, and Khamis Mushait. This was delivered two years ahead of its 2026 target. Nahdi’s omnihealth system served 1.4 million of Guests within 2024 with an NPS 81, elevating the experience and clinical outcome for Saudi patients.

- Nahdi closed the year with more than 60,000 ez-pill delivered to chronic patients which helped increase their medical adherence by 100 bps.

- Awarded as “Best Company in the Healthcare Sector for Social Responsibility”, from the Ministry of Human Resources and Social Development, which reflects our commitment to healthcare leadership within the Kingdom.

- Ranked among the top three “Great Place to Work” in the Pharma & Healthcare and Large Organizations categories in Saudi Arabia and the Middle East, and among the top eight across Asia in 2024.

Eng. Yasser Joharji, CEO of Nahdi Medical Company said:

“In today’s rapidly evolving healthcare landscape, Nahdi remains dedicated to keeping Guests firmly in the center of all our activities. We recognize that innovation is crucial to delivering the personalized, convenient, and accessible care that our Guests deserve. This guest-centric approach is at the heart of our success with all stakeholders. Inspired by the ambitious goals of Vision 2030, we are embracing technological advancements, strengthening primary care, and focusing on preventive care and chronic management initiatives to create a healthier future. Our Guests and communities are at the core of this transformation, and we are committed to empowering them on their journey to well-being.

In 2024, Nahdi has made significant progress towards its vision of becoming the most beloved and trusted partner in health and wellbeing for all its Guests, and serving their needs, through a purpose-driven mindset embedded throughout our organization. This commitment is reflected in exceeding expectations, and achieving substantial growth across all strategic pillars, effectively solidifying its foundation for long-term success. This year, Nahdi’s brand equity soared to an impressive 6.9 on the Nielsen Store Equity Index, significantly outpacing both regional and sector averages. The company facilitated around 90 million Guest transactions and expanded its presence to more than 140 cities, proudly reaching 97% of the Saudi population while rapidly gaining loyalty among Guests in the UAE too.

To further enhance accessibility for our Guests, Nahdi has successfully broadened its pharmacy network, increasing its footprint in Saudi Arabia to 1,156 pharmacies and 25 pharmacies in the UAE, ensuring that quality health and wellness products are always within reach. Retail revenues experienced a remarkable increase of 6.5%, driven by an expanding Guest base and deepened loyalty. The Nuhdeek loyalty program welcomed 800,000+ new members in 2024, contributing to more than 70% of the company’s total revenue. This growth underscores Nahdi’s ability to cultivate lasting relationships with its Guests.

Focusing on seamless and personalized experiences, Nahdi has embraced innovation by revamping its online platform. The launch of a new website and mobile application led to a significant surge in online revenue by 40%. Additionally, NahdiCare polyclinics served more than 1.4 million Guests, showcasing a notable rise in visits and reinforcing the company’s commitment to integrated health services.

At the core of Nahdi’s success is a relentless focus on engagement, efficiency, and innovation, coupled with the company’s unwavering commitment to social responsibility, key element of its healthcare leadership within the Kingdom, has earned us the prestigious ‘Best Company in the Healthcare Sector for Social Responsibility’ award. This achievement underscores Nahdi’s dedication to enhancing community well-being across Saudi Arabia and serves as a powerful motivator to further expand our impactful CSR initiatives, ensuring broader access to quality healthcare. Furthermore, Nahdi’s recognition as a ‘Great Place to Work’ reflects Nahdi’s commitment to fostering a positive, engaging, and productive workplace. To support this, the company continually implements initiatives that enhance operational efficiency while investing in cutting-edge technology. This dual commitment to both its people and its operations creates a thriving environment for both employees and Guests alike. Nahdi’s dedication to technological advancement, including the integration of AI and cloud infrastructure, has revolutionized the Guest experience. Strategic partnerships with local and international brands, along with collaborations with insurance companies, have further solidified Nahdi’s market presence. The company’s Private Label portfolio is flourishing, achieving an impressive turnover of SAR 1.2 billion, demonstrating Nahdi’s ability to provide high-quality offerings with competitive values reinforcing its position as a trusted healthcare partner in the Kingdom.

As Nahdi moves into 2025, it maintains an unwavering focus on Guest satisfaction, steadfast in its mission to expand geographically, and enhance the Omnihealth platform. With its sights set on ambitious 2030 goals, Nahdi is poised to lead the health and wellness industry, enriching the lives of its Guests and continuing to add beats to their lives. Through strategic growth, a commitment to innovation, and a focus on adapting to rapidly evolving market dynamics, Nahdi is not just responding to market demands; it is actively shaping the future of healthcare and wellbeing in the region, creating value for our Guests, shareholders, and all key stakeholders.”

Commenting on the financial results, Mohammed Alkhubani, Chief Financial Officer of Nahdi, said:

“Nahdi delivered strong financial results in 2024, with a focus on executing its ambitious growth strategy while maintaining a debt-free position. The company reported revenue of SAR 9,446 million, marking an 8.4% increase year-on-year. This performance was driven by a significant surge of 6.5% in retail revenue, supported by the growth of Nahdi’s pharmacy business, increased prescription flow, expanded insurance partnerships, and a broader product assortment. Digital growth was also a key contributor, with online revenue contribution of 22%, driven by an expanded SKU range and omnichannel initiatives.

Nahdi’s continued expansion saw the opening of 10 new pharmacies in the UAE, contributing to a 132.6% increase in revenue. The Healthcare sector, which operates across 7 cities with a network of 10 operational clinics, also performed exceptionally well, with revenue rising by 98.3%. Additionally, 4 mature polyclinics are now profit generating with a combined margin of 15%+. The company’s investments in retail expansion, digital platforms, and regional growth helped solidify its position as a leading healthcare provider in Saudi Arabia.

Nahdi achieved a market-leading gross margin of 37.4% and recorded a slight increase by 0.3% in the gross profit, while refining its pricing strategy to offer competitive value to Guests, aligning with global offerings. This has supported sales performance and drove solid top-line growth.

Operational efficiency initiatives, including cost-saving programs such as Refuel and Road to Efficiency Excellence (R2E), resulted in a 1.2% improvement in operating expenses as a percentage of revenue. OPEX reached 28.5% of revenue in 2024, with absolute OPEX increasing by 104 million to support strategic investments. Accordingly, operating profit recorded SAR 873 million.

Net profit reached SAR 821 million, with a solid 8.7% margin, supported by the income generated from Islamic Murabaha time deposits and a one-time Zakat provision release of SAR 32.7 million. EBITDA slightly increased by 0.9% reaching SAR 1,595 million, with a best-in-class margin of 16.9% in the sector.

In summary, Nahdi’s performance in 2024 showcases its resilience, strategic foresight, and commitment to long-term shareholder value, driving growth through market expansion, operational efficiency, and digital transformation.

In the year ahead, Nahdi expects steady growth despite a competitive market, driven by our growth strategy and strong financial management. Our focus will be on both topline and bottom-line growth, with the ongoing investments in key strategic initiatives. In 2025, we plan to strengthen our retail presence, solidify our position as a national healthcare leader, and enhance our capabilities to better serve our Guests. Continuous investment in digital platforms and the UAE market will be central to our strategy for sustainable growth, innovation, and value creation for our shareholders.”

Financial Performance

Nahdi maintained a strong financial position in 2024, with a solid balance sheet highlighting its financial strength and future growth potential. The company continued its zero-debt strategy, generating strong cash flows. Capital expenditures for the year totaled SAR 383 million, representing 4.1% of sales. Cash and cash equivalents reached SAR 957 million by year end. Total assets grew by 14.9% to SAR 6,173 million, up from SAR 5,371 million at the end of 2023. Total equity reached SAR 2,586 million, while total liabilities stood at SAR 3,587 million.

Nahdi’s performance was further underscored by best-in-class key performance indicators, with Return on Assets at 13.3% and Return on Equity at 31.7%. In recognition of this strong performance, the Board of Directors approved a cash dividend distribution of SAR 2.5 per share for H1 2024, with a second-half dividend of SAR 390 million (SAR 3.0 per share) planned for Q1 2025. This brings the total dividend payout to SAR 715 million, representing 87% of 2024’s net profit.