Saudi Venture Capital Invests in a Venture Capital Fund by Middle East Venture Partners (MEVP)

Ahmed Bin Abdulqader

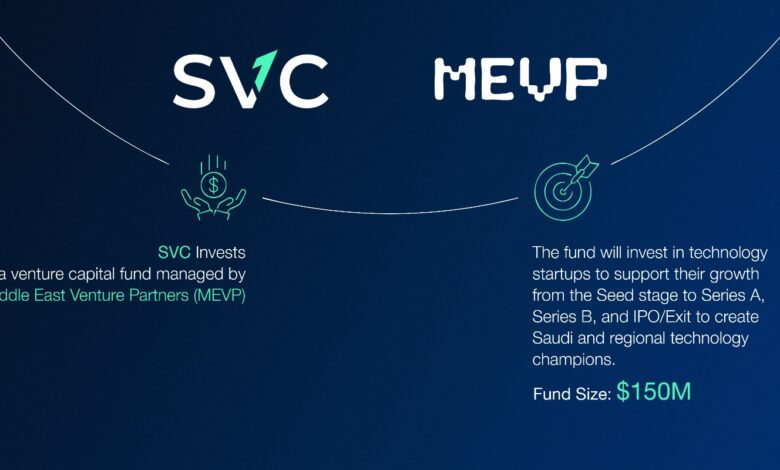

Saudi Venture Capital (SVC) announced its investment in Middle East Venture Fund IV, a venture capital fund managed by Middle East Venture Partners (MEVP). The fund size is $150 million.

The fund will support technology startups with high growth potential that will have a positive long-term impact on multiple sectors of Saudi Arabia’s rapidly modernizing economy. It will support their growth and steward their maturity from the Seed stage to Series A, Series B, and IPO/Exit to create Saudi and regional technology champions.

Dr. Nabeel Koshak, CEO and Board Member at SVC, said: “Our investment in the Middle East Venture Fund IV by MEVP supports SVC’s strategy of backing funds that invest in early-stage startups based in Saudi Arabia, aiming to foster their growth into later stages.”

Walid Mansour, Co-Founder and Co-CEO at MEVP, said: “MEVP has been a pioneering venture capital institutional investor in Saudi Arabia since 2012. Over the past decade, we have deployed more than $50 million in some of Saudi’s leading technology startups, helping to create over 12,000 high-quality jobs and also attracting $1.1 billion in co-investments that have added to Saudi Arabia’s FDI. With SVC’s support, we will expand our investment footprint further in Saudi Arabia and amplify our positive economic and social impact in the Kingdom.”

SVC is an investment company established in 2018. It is a subsidiary of the SME Bank, part of the National Development Fund. SVC aims to stimulate and sustain financing for startups and SMEs from pre-Seed to pre-IPO through investment in funds and direct investment in startups and SMEs.